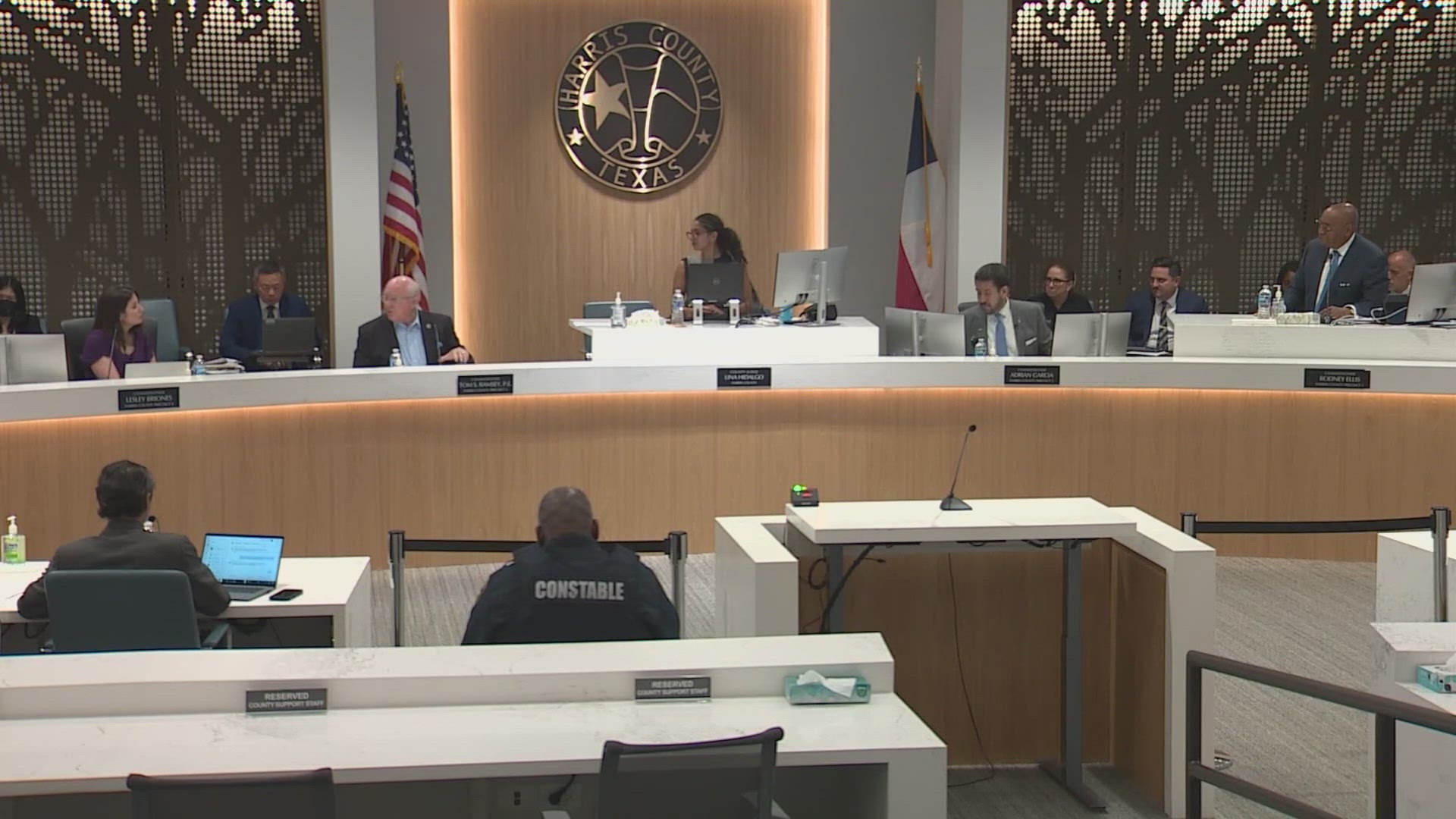

We told you on Thursday that Harris County Commissioners Court raised property taxes by 8% for the year because of this year's disaster declarations.

We've been hearing that likely means another $160 for the average home. But it turns out that's just part of the equation.

The increase means Harris County taxes will rise to 43 cents vs the current 35 cents per every $100 of valuation on a home. That starts on October 1.

The director of the Houston Association of Realtors says the tax increase is actually for all three Harris County taxing entities, not just the one.

That means that the typical $160 hike we've been hearing about is a bit of a misnomer.

“But that is only the Harris County tax rate,” said Houston Association of Realtors Director Bill Baldwin. “They also raised the tax rate for the Port of Houston and the Harris Health System, you know, Harris County Health Department. So when you add both the Port and the Health Department and the city and the county, you're really talking about a $260 increase for the typical $400,000 house.”

Baldwin adds that for your budgeting purposes, keep in mind that the Harris County Flood Control District has a bond election coming up, which means about another $60 for that same home.

The bond is expected to pass, so the average homeowner should prepare for another $320 in new Harris County taxes next year.

Relief if your property was damaged by the derecho or Beryl

While property taxes are going up, there is help for those whose property was damaged by the May derecho or Hurricane Beryl in July. If your property was more than 15% damaged, you could receive a temporary exemption of the appraised value of the property.